The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food. This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period.

When are the closing entries made?

A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. A closing entry is a journal entry made at the end of an accounting period.

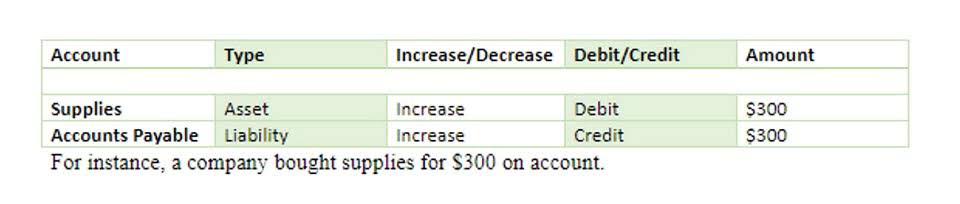

- Keeping your books balanced entails keeping a detailed record of all debits and all credits to each account.

- What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year?

- In this example, it is assumed that there is just one expense account.

- Alright, with a high-level understanding let’s dive into the 4-step close process.

- When you make closing accounting entries, you can follow the same steps.

Preparing a Closing Entry

This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account. Closing entries are a fundamental part of accounting, essential for resetting temporary accounts and ensuring accurate financial records for the next period. This process highlights a company’s financial performance and position. In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance https://www.bookstime.com/ in financial management.

What is the approximate value of your cash savings and other investments?

Afterwards, withdrawal or dividend accounts are also closing entries closed to the capital account. To close the drawing account to the capital account, we credit the drawing account and debit the capital account. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary. These finalized reports show a business’s financial position over a certain accounting period—whether a month or an entire year. Adjusting entries record items that aren’t noted in daily transactions. These items include accumulation (known as “accrual” in accounting) of real estate taxes or depreciation accrual, which need to be recorded to close the books.

- On the other hand, if the cost exceeds the income, a net loss occurs.

- Why was income summary not used in the dividends closing entry?

- The income statementsummarizes your income, as does income summary.

- Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings.

- As we mentioned, these include revenue, expense, and dividend accounts.

Closing Entries Accounting Examples (Beginners:Step by Step)

The month-end close is when a business collects financial accounting information. Using the above steps, let’s go through an example of what the closing entry process may look like. They are special entries posted at the end of an accounting period. Once we have obtained the opening trial balance, the next step is to identify errors if any, https://www.facebook.com/BooksTimeInc/ make adjusting entries, and generate an adjusted trial balance.

Closing Entry for Expense Account

- At the end of the year, it needs to be zeroed out by debiting it and crediting the Income summary account.

- With the use of modern accounting software, this process often takes place automatically.

- Lastly, prepare a post-closing trial balance to verify that the balances of the permanent accounts are correct and that the temporary accounts have been reset to zero.

- These records are then used to generate reports that can tell a business owner the financial status of their enterprise.

Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted). The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period. The owner’s drawing account will be zero and the owner’s drawing account will be closed by crediting the owner’s drawing account and debiting the capital account.