The experienced Chicago-area team at DHJJ helps you better understand what your financial data is telling you by setting up clear reporting. We help you establish a firm foundation through meaningful and regular financial statements, retirement planning, compliance, franchise-specific obligations, and tax planning services. For many franchise owners, bookkeeping difference between gross margin and gross profit is the most complex part of business operations.

The franchisor provides training, support, and a proven business model, while the franchisee is responsible for running the day-to-day operations of the sales revenue business. One of the most critical aspects of running a successful franchise is managing the finances effectively. There are several types of franchise accounting models, each with its unique advantages and challenges.

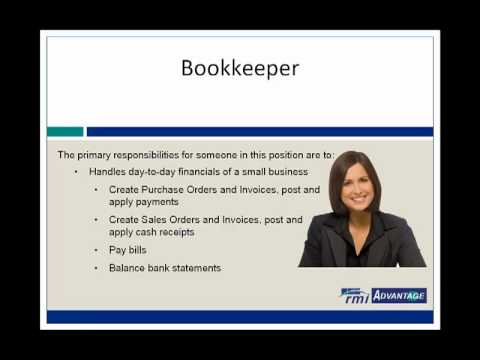

- Franchise accounting services help streamline accounts payable by implementing efficient systems for invoice processing and payment scheduling.

- Jeff Cheatham is the founder and CEO of Creative Content, a full-service copywriting and public relations firm.

- Our accounting process starts with a deep dive into how your business functions and maintains the accounting systems that support those operations.

- Virtual franchise bookkeeping is a remote financial management service tailored to franchise businesses.

- This process helps identify any discrepancies or errors in financial transactions.

Franchisee Solutions

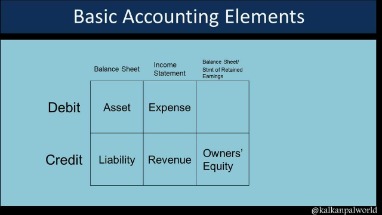

Franchise accounting is essential for the success of the franchise business. It provides accurate financial information that helps the franchise owner make informed decisions about the business. Without proper accounting, the franchise owner may not be aware of the financial health of the business, which can lead to poor decision-making and ultimately, failure. Furthermore, franchise accounting services offer confidentiality and data security measures to protect sensitive financial information. This commitment to data protection builds credibility and reassures clients of the safety of their financial data.

Franchise Accounting Services: Elevating Financial Management

These experts should be well-versed in industry-specific regulations and possess the skills to navigate complex financial scenarios. Automated software minimizes manual errors, saving time and increasing efficiency in handling complex financial transactions. Franchise owners can now use these platforms to analyze performance metrics, identify trends, and make informed business decisions. Utilize accounting software to streamline processes such as payroll management, invoicing, and expense tracking. A good accountant, preferably with a background in the franchising industry, can help mitigate your financial risk. If your franchise requires employees, they can manage payments, expenditures and tax reporting.

It’s important to work with an firm that has franchise industry knowledge and a strong track record performing accounting and auditing services. Virtual bookkeeping offers cost-efficiency, accessibility, and access to specialized expertise. It allows you to focus on your core business while professionals manage your financials remotely. It’s important for franchise owners to have a solid understanding of these key terms and concepts, as they form the foundation of franchise accounting. Revenue recognition is the process of recording revenue when it is earned, regardless of when payment is received.

In this model, the franchisor assists the franchisee in setting up an accounting system that meets the specific needs of the territory, including managing costs, revenue, and taxes. Managing the finances of a single-unit franchise can be challenging, as the franchisee has to handle all the accounting tasks independently. However, this model provides more autonomy and flexibility to the franchisee, allowing them to customize the accounting process according to their business needs. The franchisee can choose their own accounting software, hire their own accountant, and set their own financial goals. Inventory management is the process of tracking and managing inventory levels.

This way you can know who has paid and what is left to pay at a simple glance. We’ve created best practices to help franchise businesses streamline their accounting infrastructures — from franchise-friendly integrations to automated reporting, processes, and more. Our comprehensive approach to bookkeeping and accounting ensures that your financial systems are efficient and effective.

Franchises

Even if you decide to outsource your books to an accountant, payroll for accountants could drastically decrease the financial burden on your overhead. A single-unit franchise is a stand-alone business that operates independently under the franchisor’s brand name and business model. In this model, the franchisee is responsible for all financial transactions, including bookkeeping, payroll, and taxes. The franchisor provides training and support, but the accounting process is entirely managed by the franchisee.

Xendoo works with emerging and mature franchises ranging from gyms, to trades specialists and everything in between. Before paying the fee, the franchisee needs to project how much business capital they will need. For example, someone in your town could own and operate a local fast food restaurant. We strive to qualified dividend tax rate 2021 respond promptly to all inquiries and support requests, ensuring you receive the assistance you need in a timely manner. Ensure the firm you choose offers a range of packages tailored to different business sizes and needs. This flexibility allows you to select a service level that aligns with your budget constraints.